Are investors right to consider a move to cash?

The Bank of England pushing up interest rates has been positive news for savers after many years of meagre returns from their cash savings. But does that mean cash is the best place for your money?

Troubled markets

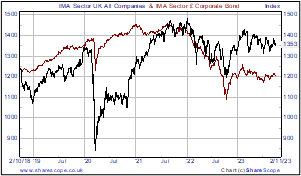

In 2022 investors saw the value of both markets and bonds fall an uncomfortable amount but it is understandable with the war in Ukraine, the inflation crisis and then rising interest rates.

As the chart below shows, we have seen some recovery but still not a full recovery, especially from government and corporate bonds, weighed down by inflation and rising interest rates.

Is a change coming?

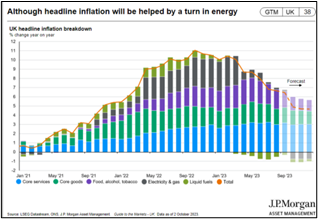

There have been predictions of a recovery throughout 2023, and even the Bank of England were overly optimistic about inflation coming down.

Progress is now being seen…but it is likely that inflation will be slow to fall and so interest rates will not drop as quickly as we might like.

Better to be safe than sorry?

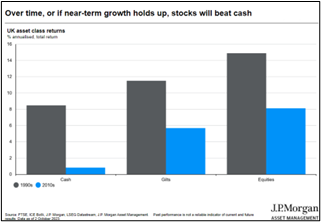

After uncertainty in markets, and seeing interest rates high, it is understandable that some investors are considering “cutting their losses” and moving to the safety of cash.

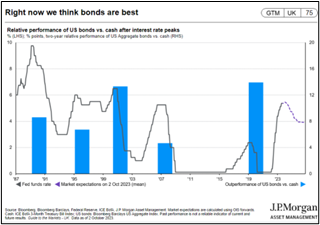

But we are likely now at, or close to, the peak in interest rates. And history tells us this means returns from cash going forwards are likely to be lower than either bonds or markets.

And over the last 30 years, we see bonds recover sharply after the peak of interest rates has past.

So what next?

We still believe that patience is needed, but that patience will be rewarded.

Get in touch with our team today for a free consultation.

0 Comments