By Michael Zacharia, Investment Analyst

Review of 2023

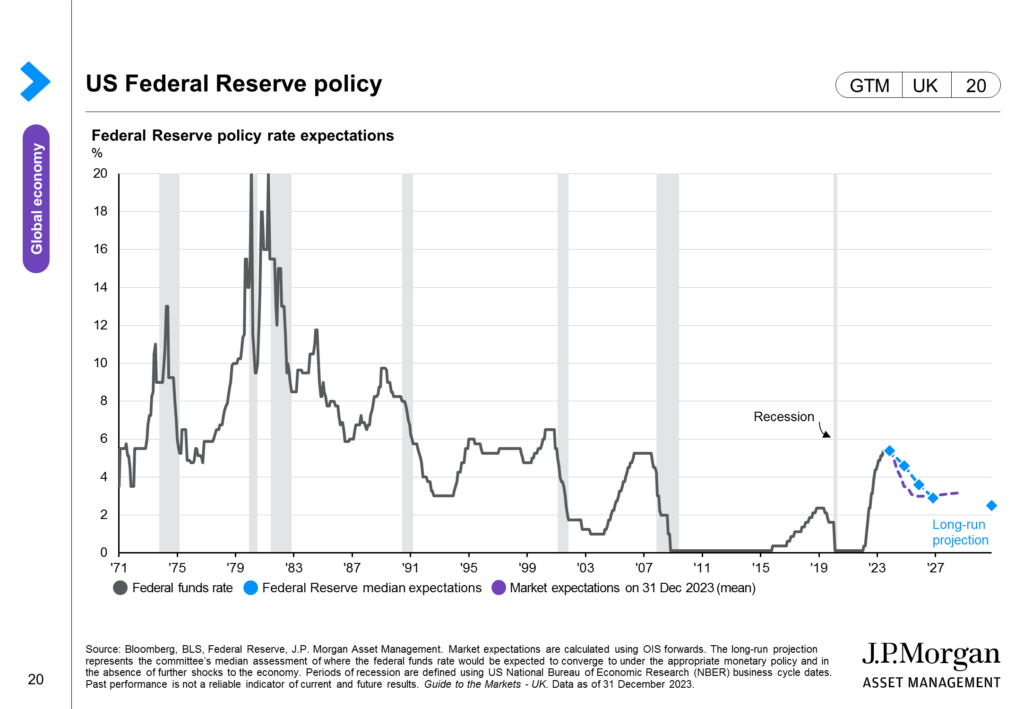

2023 saw quite a swing in the economic narrative. We began the year concerned about rampant global inflation, the expectation of recessions in most of the major economies and economists calling for interest rates to rise to record levels and to remain higher for longer.

As we neared the end of the year, we were witness to a complete turnaround in global macro expectations with inflation trending lower, no or a mild recession and expectations that interest rate cuts may be just around the corner. Off the back of this, global equities and fixed income registered strong gains.

As we prepare our outlook for 2024, we first look back at 2023 and specifically at what lessons we have learnt. The main one was to keep a long-term perspective and to stay invested.

What is the 2024 outlook for investors?

In the same way that the investors approached 2023 overly pessimistic, we try not to be too optimistic for the outlook for 2024, especially as 4.7bn people will be voting in various elections, including USA, EU, Russia and possibly the UK. This may induce volatility within markets.

Despite this we believe the outlook for most asset classes is positive. As corporate earnings increase, this will happen at different times across the various geographic regions, meaning equity diversification remains vitally important.

The outlook for fixed income (bonds) is positive against a backdrop of interest rates cuts, which in the US, could arrive as early as the 1st half of the year.

Finally, cash is no longer king. We anticipate fixed income to outperform both shorter and longer terms.

0 Comments